Table of Contents

Introduction:

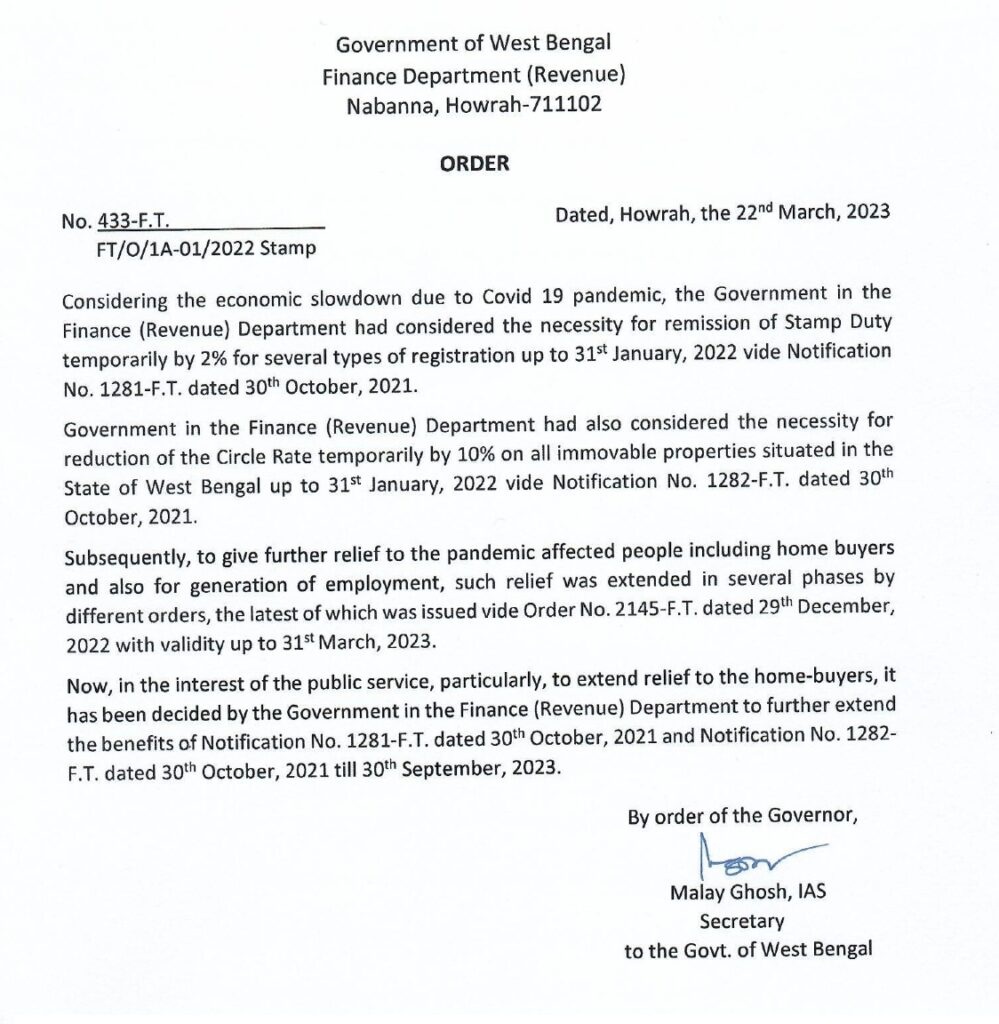

In the wake of the Covid-19 pandemic and the economic slowdown that followed, the Government of West Bengal implemented measures in the form of a temporary reduction in stamp duty and circle rates. This reduction was originally implemented with a validity up to January 31, 2022, through Notification No. 1281-F.T. and Notification No. 1282-F.T. dated October 30, 2021. These measures were later extended in several phases by different orders, with the latest order being issued on December 29, 2022, through Order No. 2145-F.T. with a validity up to March 31, 2023.

In the interest of providing continued relief to those affected by the pandemic, particularly homebuyers, the Government of West Bengal has now decided to further extend the benefits of Notification No. 1281-F.T. and Notification No. 1282-F.T. till September 30, 2023, through Notification No. 433-F. issued on March 22, 2023.

Reduction in Stamp Duty:

Stamp duty is a tax charged on property transactions, paid by the buyer on the purchase price of the property. The West Bengal Government has reduced the stamp duty temporarily by 2% for several types of registration. This reduction is aimed at stimulating the residential real estate industry and providing benefits to those affected by the Covid-19 pandemic.

Reduction in Circle Rates:

The circle rate is the minimum value of a property fixed by the government for payment of stamp duty. The West Bengal Government has reduced the circle rate temporarily by 10% on all immovable properties situated in the State of West Bengal. This reduction is aimed at providing support to those affected by the Covid-19 pandemic, particularly homebuyers.

Benefits to Homebuyers:

The reduction in stamp duty and circle rates is a significant benefit for homebuyers. It makes purchasing a property more affordable, especially during a time when the economy is facing a slowdown due to the Covid-19 pandemic. The reduction in stamp duty and circle rates has already resulted in an increase in house registrations, indicating that more people are now able to afford to buy their own homes.

Extension of Relief:

The decision to extend the reduction in stamp duty and circle rates till September 30, 2023, is a positive move by the government. It provides continued benefits to those affected by the Covid-19 pandemic, particularly homebuyers. The measures are aimed at generating employment and stimulating economic growth.

Legal Implications:

Prospective buyers must ensure that they comply with all legal formalities and understand the terms and conditions before making a purchase. The reduction in stamp duty and circle rates is subject to certain conditions, and buyers must ensure that they meet all the eligibility criteria.

Conclusion:

The extension of the reduction in stamp duty and circle rates till September 30, 2023, is a significant benefit for homebuyers. It makes purchasing a property more affordable, especially during a time when the economy is facing a slowdown due to the Covid-19 pandemic. The reduction in stamp duty and circle rate are aimed at generating employment and stimulating economic growth. Prospective buyers must ensure that they comply with all legal formalities and understand the terms and conditions before making a purchase.

Overall, the extension of relief in the form of a reduction in stamp duty and circle rates is a positive development for the real estate industry in West Bengal. It is important for prospective buyers to take advantage of this reduction in stamp duty and circle rate measures, while also ensuring that they comply with all legal formalities and understand the terms and conditions before making a purchase. The measures are aimed at providing much-needed benefits to those affected by the pandemic, and they are an important step toward stimulating economic growth in the state of West Bengal.

Disclaimer: The opinions stated here are for informational reasons only and are based on market reports and pertinent news stories. The correctness, reliability, or completeness of the information is not guaranteed by www.rmondalassociates.com, and www.rmondalassociates.com is not liable for any decisions made in reliance on the published data.